|

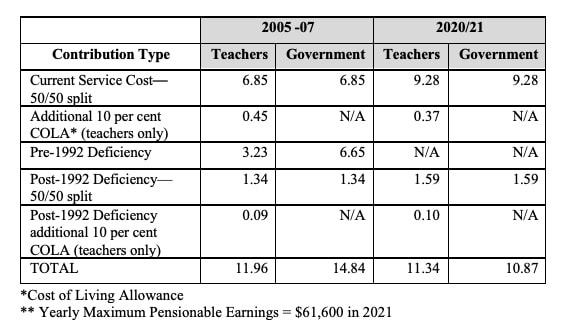

WORTH KNOWING The 2007 Pension Settlement Tackled a Massive Shortfall The Brief In 2007, an historic agreement struck between the Alberta Teachers’ Association and the Government of Alberta resolved a $7 billion problem facing teachers and the government. Known as an unfunded liability, the pension funding shortfall basically resulted from decades of underfunding of the Alberta Teachers’ Retirement Fund. The significance of resolving the longstanding issue cannot be overstated. This problem began in 1956 and was mainly caused by the government stopping contributions in return for guaranteeing the payment of teacher pensions. While this may have made sense in the booming days of the 50s, it became apparent over time that The preferred model for pensions is to have advance contributions made that grow with investment and are sufficient to cover future pension payments. Over the subsequent 35 years, numerous attempts to solve this problem and to negotiate a new agreement between government and the Association failed. By 1992, an agreement was finally struck that resulted in splitting the plan in two: for post-1992 service, the government starting contributing 50 per cent to the plan and the guarantee was removed; for pre-1992 service, the guarantee remained in place and teachers agreed to fund one-third of the pre-1992 liability. This liability was funded through higher contribution rates. The solution worked, but it was far from ideal, taking too long – almost 60 years - to fix the problem while costing both teachers and government higher contributions than necessary. In 2007, a new agreement meant Alberta teachers no longer had to fund a liability that was created before many of them were teaching, and Alberta taxpayers stood to save an estimated $47 billion over the next 55 years. As a result of this historic agreement, teachers’ contributions were reduced by 3.1 per cent due to the fact that they no longer made contributions to the pre-1992 unfunded liability. The Big Questions What is an unfunded liability? An unfunded liability, or deficiency of a pension plan, is the amount by which the plan’s liabilities exceed its assets on a given date. The total liability of the plan is the amount of money that, according to the plan’s actuary, the plan will eventually need to pay all the benefits (including pension, death and termination benefits) that participants have earned to date based on their years of pensionable service and their salaries. In 1956, the Government of Alberta moved to a pay-as-you-go funding model for their portion of the total pension contribution, thereby not having those funds building the plan assets overall. This also significantly impacted the ability of the fund to realize investment gains—growth that covers up to 80 per cent of the cost of a teacher’s pension. As of August 31, 2006, the Teachers’ Pension Plan (the plan) had a pre-1992 deficiency of $6.3 billion and a post-1992 deficiency of $742 million. As a result of the pre-1992 unfunded liability, teachers contributed 3.1 per cent more of salary than would otherwise have been necessary to support a pension plan having the same benefits. If the plan did not have an unfunded liability, teachers’ contributions in 2005 would have been 8.73 per cent of salary. The New Agreement

November 2007 Funding Agreement Between the Association and the Alberta Government Post- 1992 service funding

Unfunded liability for pre- 1992 service Effective September 2009, unfunded liability contributions ceased, and the Alberta government moved to pay-as-you-go funding by advancing sufficient funds to the plan to pay for all benefits as they come due. This solution saved taxpayers over $47 billion over the next 55 years. More information about the plan and the evolution of the 1992 and 2007 agreements can be found here. WORTH SHARING The pre-1992 unfunded liability was a direct result of the government failing to contribute to the Teachers’ Pension Plan. #WEAREATA The 2007 pension agreement provided a better solution that saved taxpayers $47 billion. #WEAREATA Alberta teachers’ pensions are deferred compensation. #WEAREATA The Alberta government does not guarantee teacher pensions. The fund is there to provide pension payments. Liabilities are shared by teachers and government. #WEAREATA Budget day is this Thursday and there is great uncertainty and anxiety about what this budget will hold for public education.

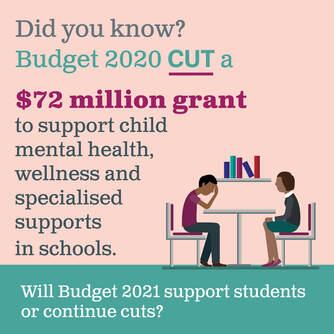

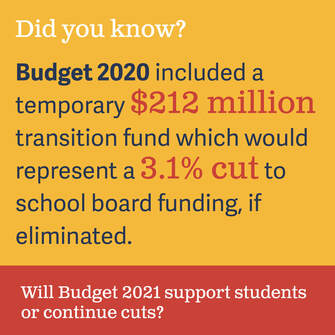

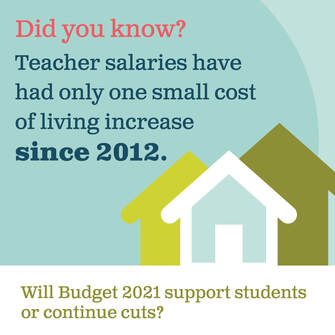

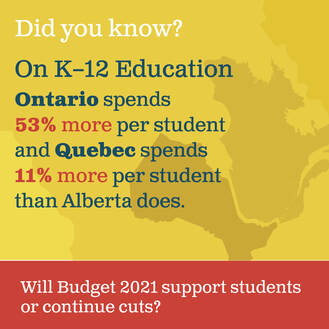

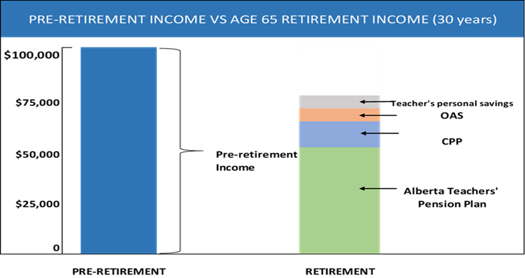

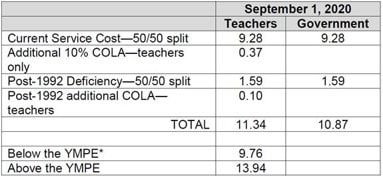

In advance of the budget being released, the Alberta Teachers' Association is reminding Albertans of some important facts about public education funding. Please share the enclosed "Did You Know?" graphics using social media to help us draw attention to current funding issues in education before the budget is introduced.  WORTH KNOWING Your Pension, Your Money, Your Future Defined benefit pension plans, like the one paid into by Alberta teachers, are increasingly rare. The Alberta Teachers’ Retirement Fund (ATRF) has provided the finest quality in both service to plan members and investment portfolios for the past 80 years. While the investment work of ATRF may be changing as a result of Bill 22, ATRF is still the pension administrator and trustee of the plan. This means that they will continue to collect pension contributions, calculate service and administer pension payments. You may be at a point in your career where retirement seems so far off it hardly feels real. However, it is important to learn about your pension no matter how distant you are from “Freedom 55.” For most Alberta teachers, the largest source of income in their retirement is the pension they receive from the ATRF. This pension is an important and valuable piece of your compensation, which is why Alberta teachers are fighting so hard to protect it. By taking some of their compensation as pension contributions, teachers have agreed to defer part of their earnings until retirement. Teachers and the Government of Alberta pay for the plan together, govern it together and share the risk. If you retire with 30 years of service, you could receive approximately 50 per cent of your preretirement income. In addition, every January, a cost-of-living adjustment equal to 70 per cent of the annual increase in the Alberta Consumer Price Index is applied to your pension. Defined benefit pension plans are under attack because they provide a benefit based on salary and service and are mandated by the plan document or legislation even in the case of losses to the assets of the plan. Those losses must be funded by the plan sponsors (in the case of the teachers’ plan, by teachers and the government), who bear the risk that the assets will not cover the pensions promised to retirees. Teachers pay more than half the contributions needed to fund their current service. In short, teachers are paying for their pension. Teachers also pay for past service deficiencies—all plan deficiencies must be made up within 15 years of their discovery. Teachers and the government share the burden of those payments equally. Teachers pay a percentage of their salaries into the pension plan to make up for deficiencies in the plan. The benefit teachers receive from their pensions every year they earn service is deducted from their RRSP room. Teachers and other taxpayers in defined benefit plans have no advantage over other taxpayers in saving for retirement. The 11.34 per cent average contribution rate is broken up for teachers at 9.76 per cent of salary up to the YMPE ($61,600*) and 13.94 per cent on salary earned over the YMPE.

* For 2021.This amount changes each January 1. WORTH SHARING The defined benefit pension provided by the Alberta Teachers’ Retirement Fund is an important and valuable piece of our compensation, which is why Alberta teachers are fighting so hard to protect it. It is our pension, our money and our future. #WEAREATA Important Dates and Deadlines

Monday, March 08, 2021--Voting opens at 8:00 AM. Thursday, March 11, 2021--Voting closes at 5:00 PM. Friday, March 12, 2021--Results of the 2021 PEC election are announced. Everyone Needs an Online ATA Account to Vote Members without an online ATA account can go to www.teachers.ab.ca to request one. This one-time transaction requires teachers to provide their teaching certificate numbers. Please see the back of this memo for information on how members can get their teaching certificate numbers and set up an online ATA account. Please see the MEMO WORTH KNOWING

Employment Insurance Maternity Benefits Important changes to Employment Insurance maternity benefits: Service Canada introduces a temporary waiver program for the one-week waiting period When you make a claim for Employment Insurance (EI) maternity benefits, there is normally a one-week period for which you are not paid. This is called the waiting period. It is like the deductible for other types of insurance. Temporarily waiving the waiting period is intended to enable individuals to be paid for the first week of unemployment and enhance income support to Canadians during the pandemic. School divisions, however, provide full pay to teachers during the one-week period so that new mothers who select a standard maternity and parental EI benefit would receive a full week of pay from the employer during the one-week waiting period; they would then receive 15 weeks of maternity benefit and 35 weeks of parental benefit. With the introduction of this temporary waiver program, every teacher who establishes an initial claim for EI maternity benefits between January 31 and September 25, 2021, will have their one-week waiting period waived automatically when their claim is processed. While waiving the waiting period will not affect the maximum number of weeks of EI benefits that you may receive, this could affect your employer-provided supplemental benefit plan. School divisions provide a top-up during periods of maternity leave in accordance with your individual collective agreements. Service Canada is supposed to ensure that this is taken into consideration when determining whether you should serve the waiting period. This automatic consideration will only occur if the Record of Employment (ROE) submitted by the employer records that you are receiving full pay for the week after you start your maternity leave. If Service Canada does not automatically account for the one week of pay from the employer and waives the waiting period, then you must call Service Canada at 1-800-206-7218 and explain that the waiver does not benefit you. You must ask that Service Canada apply consideration to determine that you should serve the waiting period and not be subject to the waiver. Remember that this only applies if you establish an initial claim for EI maternity benefits between January 31 and September 25, 2021. Why is this change being implemented now? In recent weeks, Canada has experienced an increase in COVID-19 infections. The resulting imposition of public health measures is increasing financial pressure on workers. Waiving the waiting period will enable individuals to be paid for the first week of unemployment. WORTH SHARING Service Canada has introduced changes to the waiting period of Employment Insurance benefits. If teachers are not exempted from the waiver, they could lose one week of income support as the number of weeks of EI benefits will not change as a result of the temporary waiver program. To speak about your individual claim, call Service Canada at 1-800-206-7218. #WEAREATA |

Details

Updates from ATA ProvincialArchives

June 2024

Categories |

RSS Feed

RSS Feed