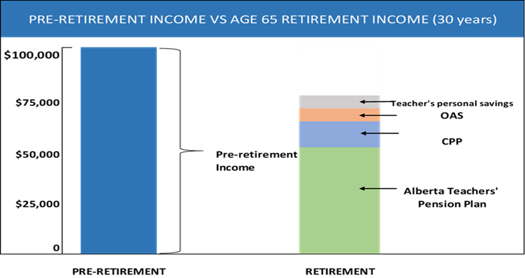

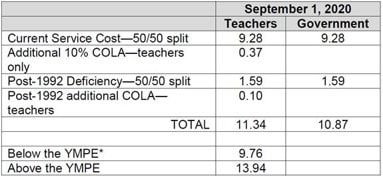

WORTH KNOWING Your Pension, Your Money, Your Future Defined benefit pension plans, like the one paid into by Alberta teachers, are increasingly rare. The Alberta Teachers’ Retirement Fund (ATRF) has provided the finest quality in both service to plan members and investment portfolios for the past 80 years. While the investment work of ATRF may be changing as a result of Bill 22, ATRF is still the pension administrator and trustee of the plan. This means that they will continue to collect pension contributions, calculate service and administer pension payments. You may be at a point in your career where retirement seems so far off it hardly feels real. However, it is important to learn about your pension no matter how distant you are from “Freedom 55.” For most Alberta teachers, the largest source of income in their retirement is the pension they receive from the ATRF. This pension is an important and valuable piece of your compensation, which is why Alberta teachers are fighting so hard to protect it. By taking some of their compensation as pension contributions, teachers have agreed to defer part of their earnings until retirement. Teachers and the Government of Alberta pay for the plan together, govern it together and share the risk. If you retire with 30 years of service, you could receive approximately 50 per cent of your preretirement income. In addition, every January, a cost-of-living adjustment equal to 70 per cent of the annual increase in the Alberta Consumer Price Index is applied to your pension. Defined benefit pension plans are under attack because they provide a benefit based on salary and service and are mandated by the plan document or legislation even in the case of losses to the assets of the plan. Those losses must be funded by the plan sponsors (in the case of the teachers’ plan, by teachers and the government), who bear the risk that the assets will not cover the pensions promised to retirees. Teachers pay more than half the contributions needed to fund their current service. In short, teachers are paying for their pension. Teachers also pay for past service deficiencies—all plan deficiencies must be made up within 15 years of their discovery. Teachers and the government share the burden of those payments equally. Teachers pay a percentage of their salaries into the pension plan to make up for deficiencies in the plan. The benefit teachers receive from their pensions every year they earn service is deducted from their RRSP room. Teachers and other taxpayers in defined benefit plans have no advantage over other taxpayers in saving for retirement. The 11.34 per cent average contribution rate is broken up for teachers at 9.76 per cent of salary up to the YMPE ($61,600*) and 13.94 per cent on salary earned over the YMPE.

* For 2021.This amount changes each January 1. WORTH SHARING The defined benefit pension provided by the Alberta Teachers’ Retirement Fund is an important and valuable piece of our compensation, which is why Alberta teachers are fighting so hard to protect it. It is our pension, our money and our future. #WEAREATA Comments are closed.

|

Details

Updates from ATA ProvincialArchives

June 2024

Categories |

RSS Feed

RSS Feed