|

WORTH KNOWING

Changes to Public Health Policy and School Safety Alberta premier Jason Kenney has announced that effective Sunday, February 13, 2022, at 11:59 pm, the province will no longer require masking for children and youth in schools or for Albertans aged 12 and under in any setting. The target date for the second phase of the government’s plan is March 1, when the province plans to remove the remaining restrictions, including the indoor mask mandate, work-from-home requirements, remaining capacity limits, limits on social gatherings and screening for youth activities. The abrupt changes during the latest COVID-19 provincial update have left Alberta teachers with many questions about the safety of their workplaces and their employers’ responsibilities. Here are some key points of information: · School divisions are legally able to maintain a mask mandate; however, even if they maintain the mandate, divisions cannot refuse entry or access to students because of their individual and personal choice not to wear a mask. · Amendments made to the Occupational Health and Safety Act (OHS Act) in December 2021 significantly changed the concept of dangerous work and the right to refuse dangerous work (section 17 of the OHS Act). Currently, the OHS Act enables workers to refuse work only if they reasonably believe that there is an undue hazard at the work site or that particular work poses an undue hazard to themselves or others. o In this section of the OHS Act, “undue hazard” in relation to any occupation includes a hazard that poses a serious and immediate threat to the health and safety of a person. o The act provides examples of undue hazards, such as sudden infrastructure collapses that result in an unsafe physical environment or a danger that would normally stop work, such as broken or damaged tools/equipment, or a gas leak. · An undue hazard is a serious and immediate threat to health and safety that the refusing worker actually observes or experiences at their work site. · In refusing the work, in s 17(3) of the OHS Act, the worker needs to ensure, as far as it is reasonable to do so, that the refusal does not endanger the health and safety of any other person. This could create a challenge for a teacher refusing the work and its impact on the students. General health and safety concerns are not dealt with under the work refusal process, as they are not considered undue hazards. While a respiratory virus can be serious, it can be open to interpretation as to whether a respiratory illness is seen as a serious and immediate threat, particularly in the context of the experience gained with COVID-19. This is where the hazard assessment and controls come into play. A possible avenue to discuss the controls in place and to address potential refusals to perform work based on concerns related to coronavirus could be to work with the joint health and safety committee. Employers must work with the committee in responding to concerns. What Can Teachers Do? Alberta teachers can raise concerns about their work environment if they reasonably believe there is an “undue hazard.” They need to do this promptly and with their supervisor, who is likely the principal or the designated person on the health and safety committee.

Teachers can also reach out to their local and the health and safety committee and request that masking be discussed. Even with the changes announced by the Government of Alberta, employers are still required to conduct hazard assessments and use the suite of controls, which include 1. engineering controls—ventilation and physical barriers; 2. administrative controls—training, hand hygiene, physical distancing and so on; and 3. personal protective equipment (PPE). WORTH SHARING The abrupt changes during the latest COVID-19 provincial update have left Alberta teachers with many questions about the safety of their workplaces and their employers’ responsibilities. Teachers can access more information by calling Teacher Employment Services at 1‑800‑232‑7208. #WEAREATA Your Central Table Bargaining Committee (CTBC) met with the Teachers’ Employer Bargaining Association (TEBA) for another productive meeting on January 26th.

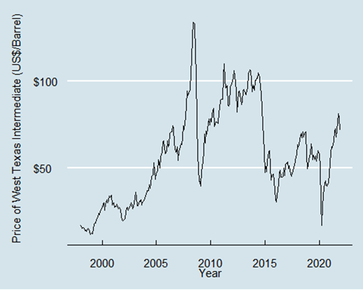

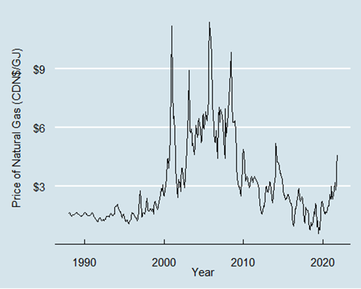

It was another productive meeting. However, teachers should also be aware that CTBC has added some new items to the initial proposal. Read the latest post from Heather McCaig, CTBC Member and District Representative for South East, on the Bargainer's Blog for an update. Prospects for a Balanced Budget What a fiscal roller coaster the past few years have been. Alberta got clobbered by a significant decline in oil prices beginning in late 2014, and things haven’t been the same since. In the spring of 2020, we got hit with the pandemic and that drove oil prices even lower, along with a significant increase in unemployment and the resulting loss of income tax revenue. On February 25, 2021, the provincial budget was released, with an $18.3 billion deficit. Fast-forward to August 2021, and the release of the first-quarter fiscal update. In that short time, the projected deficit had fallen to $7.5 billion—a $10.5 billion improvement! In November, the second-quarter fiscal update was released, with a further reduction in the forecasted deficit, now projected to be $5.8 billion. Recently there has even been talk about the budget being balanced, or perhaps even a surplus, by 2023. What is behind this reversal of fortunes? There are several reasons for the better-than-expected fiscal results. First, general economic conditions have improved faster than many expected and that has led to an increase in tax revenues. Second and more important, oil prices have been generally good over the past year and that has led to an increase in royalty revenues for the province. General Economic Conditions Generally speaking, economic conditions in Alberta have improved significantly over the past year. The original budget assumed that unemployment would continue at about 9.9 per cent. By the second quarter, the unemployment rate had fallen to 8.8 per cent; it now sits at about 7.5 per cent. Furthermore, the number of jobs in Alberta has returned to prepandemic levels. This contributes to higher than expected income tax revenues. Nominal GDP (gross domestic product) fell by 16.1 per cent in 2020 due to the pandemic. It was expected to increase by 8.8 per cent in the 2021 fiscal year, but by the second quarter it had increased by 18.1 per cent over 2020. Bear in mind that increases in nominal GDP can be caused by greater economic output and inflation—both of which have been a factor. Real GDP has grown by 6.1 per cent over 2020, but in 2020, it fell by 7.9 per cent over 2019. This means that we are almost back to where we were before the pandemic began. As a result of improving economic conditions, income tax revenues are expected to be about $6 billion higher than originally budgeted for. Oil and Gas Prices The original budget was based on an assumed price of West Texas Intermediate (WTI) of US$46 per barrel. However, since February the price has ranged from US$52 per barrel to US$81.48 per barrel. (Note: West Texas Intermediate is a reference price that largely drives the price of Western Canada Select.) The second-quarter update revised the forecast price for WTI to US$70.50 per barrel. In addition, production volumes have been higher than originally assumed and production estimates have been revised upward by about 6 per cent. Natural gas has been another bright spot for us. The original budget assumed a price of CDN$2.60/GJ, but that has been revised upward to $3.30. Natural gas volumes continue on pace with the forecast levels in the original budget. These two resource markets mean that Alberta’s resource revenue is now expected to be about $8.2 billion higher than originally assumed. This means that over half of the revenue improvement is due to resource revenues. More on that later. Future Risks While there is considerable reason for optimism going forward, there are also some very significant risks. As usual, Alberta’s fortunes are tied to the price of energy. As noted earlier, over half of the improvement in revenues is due to royalties; this is no accident. In Alberta, resource revenues make up a larger portion of total revenues than in any other province; in many years, resource revenue as a percentage of total revenue is double that of our nearest rival, Saskatchewan. In 2008, resource revenues made up about 30 per cent of provincial government revenues. In 2020, resource revenue made up only about 8 per cent of total revenues. That reversal was not due to a sudden increase in nonresource revenues, but rather to a collapse in resource revenues. Therein lies the problem: Alberta’s fiscal fortunes are heavily reliant on something that we have no control over, and we continue to ride a fiscal roller coaster. COVID While COVID remains with us, there are signs of hope. Many public health experts are optimistic that the Omicron variant signals the end of the pandemic and a move to an endemic phase. The number of active cases in Alberta continues to drop daily, and that is encouraging. However, until COVID vaccines are revised to address the characteristics of the Omicron variant, which seems more able to infect fully vaccinated people, we remain at risk. Furthermore, an interesting (and frightening) characteristic of viruses is their ability to mutate. We believe that for the foreseeable future, COVID continues to be a looming threat to the economy. Oil and Gas Prices Oil prices are very volatile and yet they strongly influence Alberta Government revenues. Just how volatile are they? The graph below shows the price of West Texas Intermediate (in US dollars) since 1998. Natural gas prices can be just as volatile as oil prices. The graph below shows natural gas prices (in Canadian dollars) since 1988. Volatility in oil and gas prices creates a two-pronged problem for Alberta. First is its direct effect on government revenues due to changes in resource royalties. The second problem can be even greater at times, and that is the loss of employment income when falling prices lead to reductions in energy exploration activities. The big risk for us is that these prices are entirely beyond our control. They are driven by factors in world markets that we cannot influence. Last year when oil prices collapsed, that collapse was due to a price war between Russia and OPEC (primarily led by Saudi Arabia) and declining demand due to the pandemic; we had no ability to influence either event. Russia’s sabre-rattling in the Crimea is likely to increase price volatility: prices may jump or they may collapse, all depending on what Russia does. Hang on—it’s going to be a bumpy ride.

WORTH SHARING While there is considerable reason for optimism in Alberta’s Budget going forward, there are also some very significant risks. Alberta’s fortunes are tied to the price of energy and resource revenues and make up a larger portion of total revenues than in any other province so Alberta is heavily reliant on something that we have no control over. Unpredictable revenue sources will continue to create a fiscal roller coaster for the Alberta’s budget. #WEAREATA |

Details

Updates from ATA ProvincialArchives

June 2024

Categories |

RSS Feed

RSS Feed