|

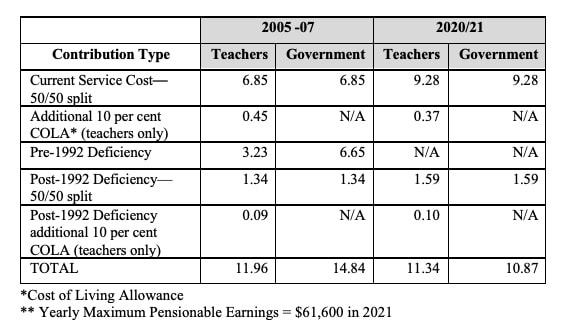

WORTH KNOWING The 2007 Pension Settlement Tackled a Massive Shortfall The Brief In 2007, an historic agreement struck between the Alberta Teachers’ Association and the Government of Alberta resolved a $7 billion problem facing teachers and the government. Known as an unfunded liability, the pension funding shortfall basically resulted from decades of underfunding of the Alberta Teachers’ Retirement Fund. The significance of resolving the longstanding issue cannot be overstated. This problem began in 1956 and was mainly caused by the government stopping contributions in return for guaranteeing the payment of teacher pensions. While this may have made sense in the booming days of the 50s, it became apparent over time that The preferred model for pensions is to have advance contributions made that grow with investment and are sufficient to cover future pension payments. Over the subsequent 35 years, numerous attempts to solve this problem and to negotiate a new agreement between government and the Association failed. By 1992, an agreement was finally struck that resulted in splitting the plan in two: for post-1992 service, the government starting contributing 50 per cent to the plan and the guarantee was removed; for pre-1992 service, the guarantee remained in place and teachers agreed to fund one-third of the pre-1992 liability. This liability was funded through higher contribution rates. The solution worked, but it was far from ideal, taking too long – almost 60 years - to fix the problem while costing both teachers and government higher contributions than necessary. In 2007, a new agreement meant Alberta teachers no longer had to fund a liability that was created before many of them were teaching, and Alberta taxpayers stood to save an estimated $47 billion over the next 55 years. As a result of this historic agreement, teachers’ contributions were reduced by 3.1 per cent due to the fact that they no longer made contributions to the pre-1992 unfunded liability. The Big Questions What is an unfunded liability? An unfunded liability, or deficiency of a pension plan, is the amount by which the plan’s liabilities exceed its assets on a given date. The total liability of the plan is the amount of money that, according to the plan’s actuary, the plan will eventually need to pay all the benefits (including pension, death and termination benefits) that participants have earned to date based on their years of pensionable service and their salaries. In 1956, the Government of Alberta moved to a pay-as-you-go funding model for their portion of the total pension contribution, thereby not having those funds building the plan assets overall. This also significantly impacted the ability of the fund to realize investment gains—growth that covers up to 80 per cent of the cost of a teacher’s pension. As of August 31, 2006, the Teachers’ Pension Plan (the plan) had a pre-1992 deficiency of $6.3 billion and a post-1992 deficiency of $742 million. As a result of the pre-1992 unfunded liability, teachers contributed 3.1 per cent more of salary than would otherwise have been necessary to support a pension plan having the same benefits. If the plan did not have an unfunded liability, teachers’ contributions in 2005 would have been 8.73 per cent of salary. The New Agreement

November 2007 Funding Agreement Between the Association and the Alberta Government Post- 1992 service funding

Unfunded liability for pre- 1992 service Effective September 2009, unfunded liability contributions ceased, and the Alberta government moved to pay-as-you-go funding by advancing sufficient funds to the plan to pay for all benefits as they come due. This solution saved taxpayers over $47 billion over the next 55 years. More information about the plan and the evolution of the 1992 and 2007 agreements can be found here. WORTH SHARING The pre-1992 unfunded liability was a direct result of the government failing to contribute to the Teachers’ Pension Plan. #WEAREATA The 2007 pension agreement provided a better solution that saved taxpayers $47 billion. #WEAREATA Alberta teachers’ pensions are deferred compensation. #WEAREATA The Alberta government does not guarantee teacher pensions. The fund is there to provide pension payments. Liabilities are shared by teachers and government. #WEAREATA Comments are closed.

|

Details

Updates from ATA ProvincialArchives

June 2024

Categories |

RSS Feed

RSS Feed